A simple financial tracking strategy that saved me hundreds

I despise complicated tracking plans. Whether it's for calories, food nutrition, books, or money. I can't get myself to track everything all the time. Even with tools that try to automate things, they're hit or miss.

In an earlier post, I talked about how I keep a budget. This helps me ensure I'm not spending more than I'm making and that I'm limiting my spending on certain categories. But there was still something missing. How do I know how much I have in each of my accounts on a regular basis? How do I know if I'm meeting my long-term goals? How can I make all this easy for me?

I decided to look at my finances from a big-picture perspective and to choose a very simple strategy that I could stick to. I have an account at two different banks, an investment account at two companies (Wealthsimple and QuestTrade), and a couple of RRSP accounts. All I want to know is how much I have in these accounts on a regular interval which I chose to be monthly.

During this time, I would also check how my investments are doing and whether I need to rebalance. Checking them monthly stops me from being a day trader. Believe me, it's fun at first to be a day trader but you'll realize quickly it's not a game you can win. It also becomes an addiction to check your investments 40 times a day and leads to constant distraction.

I also check my credit card statement to make sure nothing is out of the ordinary. Sometimes you may not get the refund you expected. Or you may realize you forgot to cancel a subscription.

The Method

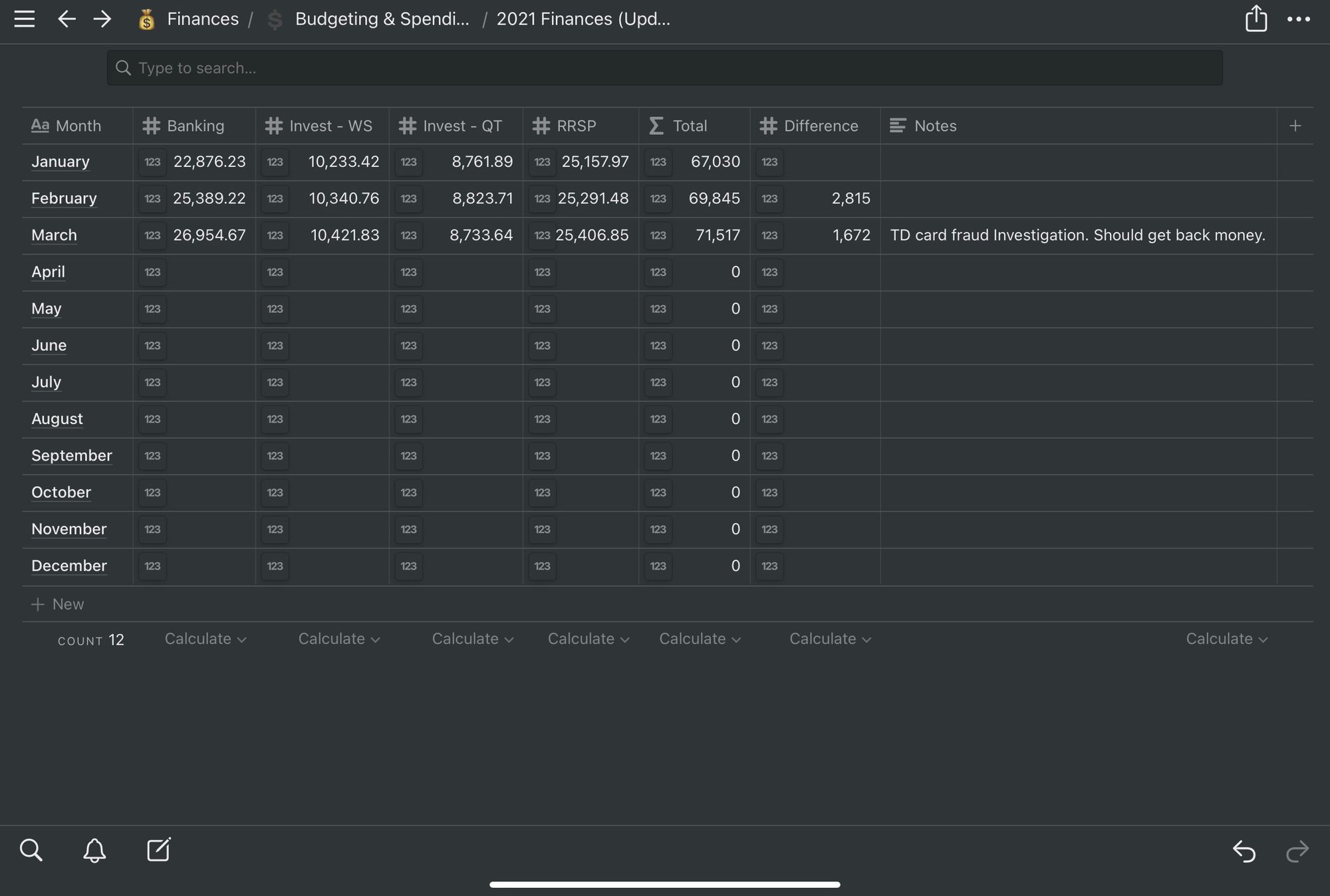

On a Notion page, I set up a table with a column for each account (I lumped together chequing accounts under "Banking"), a totals column, a net difference column, and a notes column. Every month I go through all my accounts and note down the amounts. I try and do it on the first of every month, but sometimes it doesn't pan out. That's ok. I just note down the amount on the day I do it. Here's a sample of what that page looks like (not my actual numbers 😁).

The net change helps me see patterns over time. The notes column helps me clarify anything that is of significance. For example, when I make a big purchase that is out of the ordinary that affects the net change pattern, I write down what I bought so I can remember. In the above example, I note down the fraud in one of my bank accounts (read on for more).

It's this simple to have some visibility into your finances:

- Every month, go through each account and note down the amount in separate columns.

- While you are noting down the amounts, check your credit card statement to make sure everything is correct. Also, check your investment portfolio to see how you're doing.

- In another column, tally up all the amounts in the row.

- In another column, calculate the difference between the total amounts from last month and this month.

- Note down anything of significance.

How I Saved Hundreds

One month as I was checking my finances I noticed a drop in one of my chequing accounts that I rarely use. I looked at the transactions and saw a debit of $517.22 for "AMZN Mktp CA _V". A quick Google search turned up mentions of fraud. I immediately called my bank. The agent asked if I see any other transactions like this so I went back further than when I started my monthly tracking and noticed many more smaller debits for the same item.

Turns out my account was compromised and someone was taking money in small chunks so I wouldn't notice. Then they got comfortable and began taking larger amounts. I froze my account and terminated my card and opened an investigation to see if I can get some of my money back. A couple weeks later, I had most of the money returned. Since some of the transactions were longer than 3 months before, I couldn't get those back unfortunately.

I only lost a small amount in the end but it could have been thousands if I didn't start doing my monthly review. If I had caught this sooner, I could have gotten all my money back and stopped any further unauthorized debits. If you're like me and don't like complicated financial tracking, give this a try as a first step. It's much better than flying blind like I was doing for a long time.